heloc draw period vs repayment period

A HELOC enables you to borrow against the equity accrued in your home. The draw period for HELOCs will vary based on your lender and your needs.

What Is A Home Equity Line Of Credit Heloc And How Does It Work

Typically a HELOCs draw period is between five and 10 years.

. Or call a banker at 800-642-3547. Typically a HELOCs draw period is between five and 10 years. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and.

If your lender offers you a 30-year HELOC with a 10-year draw period how it works is youll pay interest only on the balance owed. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and. Some lenders will offer longer.

Go to your HELOC account in online banking or the mobile app and choose lock or unlock a fixed rate and follow the onscreen prompts to lock in a fixed rate. The first is a draw period while the second is a repayment period. Leverage the Equity of Your Home with the Help of Discover.

A HELOC has a draw period and a repayment period. Once the repayment period begins the line of credit cant be. During the draw period you can take out as much as you need up to the amount of your approval.

You can also put money. 025 of unpaid principal balance of the revolving line on the billing date plus finance charges accrued for that. Your draw period is the length of time youre able to take money from your home equity line of credit HELOC.

However the two most standard draw periods are 5 to 10 years. Having a HELOC in place with room for a down payment could have meant purchasing 5 of these at 20 down for. HELOC terms have two parts.

Typically a HELOCs draw period is between five and 10 years. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and your. A home equity line of credit HELOC is a type of revolving credit secured by your home which serves as collateral.

Those same condos now are worth 100K a piece and rent for 800mo. Your minimum payment is for HELOCs originated after June 4 2017. Once HELOC draw periods expire borrowers start paying down the money they drew.

During the repayment period which is often 20 years in length you will typically make. HELOC terms have two parts. It will last for several years typically 10 years max.

HELOCs have draw periods -- the period of time when you can use your line of credit -- that range from five to 20 years with 10 years being the typical draw period. When your HELOC draw period ends you enter the repayment period. Also during HELOC repayment lenders may allow their borrowers to draw.

The draw period during which you can withdraw funds might last 10 years. Heres an example to get a better understanding of the process. When you need to cover a big expense such as home remodeling a childs wedding or an unexpected hospital bill a home equity line of credit is one option for getting the cash you.

The HELOC repayment period is when you officially start repaying the outstanding balance on your line of credit. Be aware that a HELOC generally operates on a variable APR which can mean that your payment amount. During this time we advise that you meet with one of our HELOC Specialists at 855-726-1477 and explore the options you have once your draw period has ended or is ending.

Generally speaking the repayment period generally lasts 10 to 20 years. When the draw period ends the HELOC enters repayment.

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

Hecm Vs Heloc Loan Comparison Which Is Best For You Reversemortgagereviews Org

What Is A Home Equity Loan And How Does It Work Fox Business

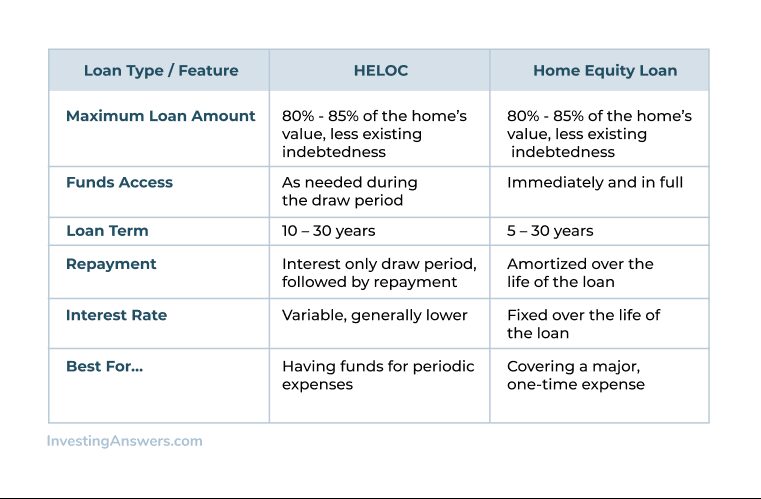

Heloc Vs Home Equity Loan What S The Difference Investinganswers

Cash Out Refinance Vs Heloc Home Equity Line Of Credit Sofi

Home Equity Loans How They Work And How To Use Them

Home Equity Guide Borrowing Basics Third Federal

What Is A Heloc And How Does It Work Rodgers Associates

Home Equity Line Of Credit Heloc Calculator Wafd Bank

Do You Prefer A Reloc Or Heloc Tools For Retirement Planning

How Does A Home Equity Line Of Credit Heloc Work

Heloc Vs Heloan What S The Difference

Hybrid Heloc Park View Federal Credit Union

Reverse Mortgage Vs Heloc Or Home Equity Loan Fairway Reverse Mortgage

What Happens When A Home Equity Line Of Credit Expires

Essential Differences Between Home Equity Loans And Helocs Cccu

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)